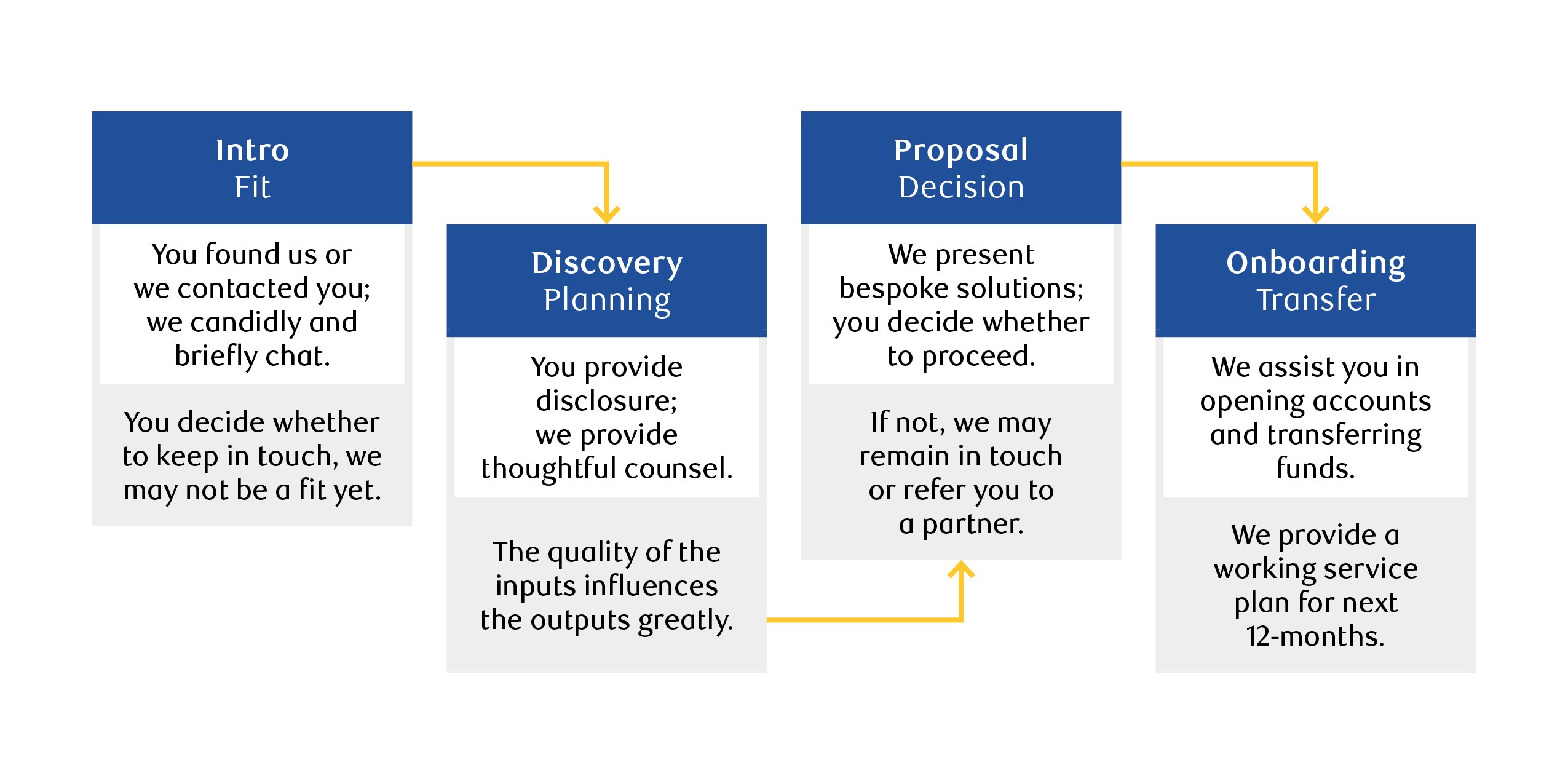

Onboarding

Our journey together begins with a structured onboarding process tailored to your unique needs:

- Discovery: We start by understanding your family’s priorities, financial landscape, and long-term aspirations.

- Analysis: Our team evaluates opportunities and identifies potential risks to craft a bespoke strategy.

- Collaboration: We work alongside you and your trusted professionals to refine and finalize the plan.

- Implementation: With your approval, we seamlessly execute the plan, ensuring every detail aligns with your goals.

Having a single team oversee the moving parts created clarity and saved us time.

Client -- Physician and Lawyer

Integrated Planning

Our integrated planning services provide a holistic approach to managing your wealth. By consolidating expertise across key areas, we ensure every facet of your financial well-being is accounted for. These services include:

Estate & Legacy Planning

• Structuring your estate to minimize taxes and ensure a smooth wealth transition.

• Establishing trusts that can be utilized during your lifetime or for future generations.

• Incorporating philanthropic strategies to align your values with your legacy goals.

Tax Optimization & Financial Planning

• Advanced tax strategies to preserve wealth and reduce liabilities.

• Personalized financial planning to adapt to life’s evolving needs.

• Guidance from professionals with expertise in high-net-worth taxation.

Business Succession & Pre- and Post-Sale Planning

• Planning for seamless ownership transitions and business sales.

• Collaborating with chartered accountants, business valuators, and investment bankers.

• Post-sale strategies to align liquidity with long-term goals.

Insurance Strategies

• Developing tax-efficient insurance solutions to preserve wealth.

• Strategies to minimize estate taxes and ensure financial security for beneficiaries.

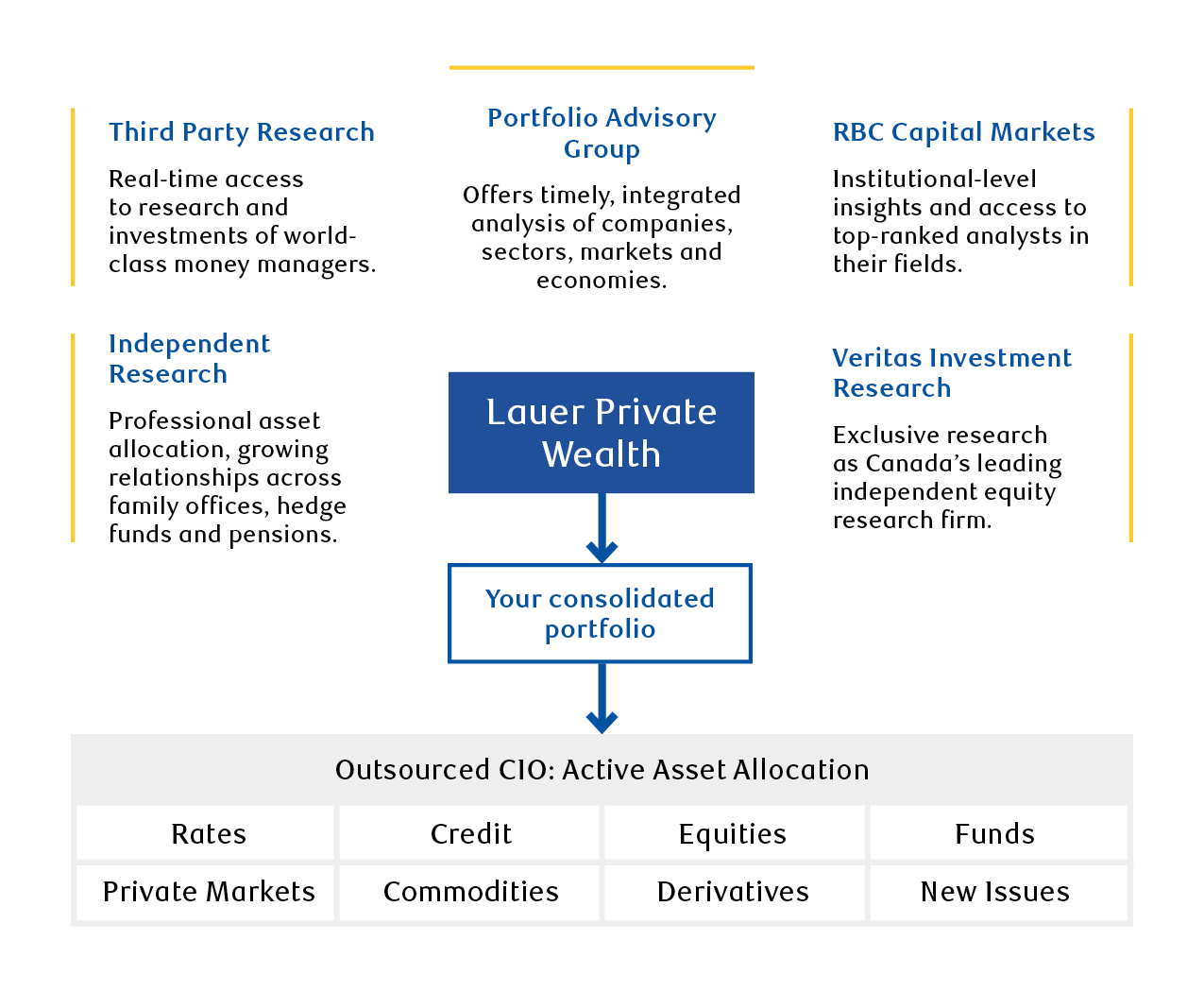

Portfolio Management

Building upon the foundation of Integrated Planning, Portfolio Management represents the active implementation and oversight of your financial strategies. Your portfolio is managed with precision, combining strategic foresight and tactical adaptability to achieve long-term success. Our approach includes:

Strategic Asset Allocation: Strategic and tactical asset mixes based on your goals and market conditions.

Tax Efficiency: A focus on minimizing liabilities to maximize after-tax returns.

Institutional Expertise: Allocation to asset managers with institutional-grade infrastructure and best practices.

Ongoing Monitoring: Regular evaluations of cash flow, risk frameworks, and performance metrics.

Family Engagement

We believe that wealth management extends beyond numbers. It’s about empowering your family to build a legacy of stewardship and success. Through meaningful engagement, we ensure the next generation is prepared for their roles and responsibilities:

Facilitating Family Dialogue: Open conversations about financial goals, values, and aspirations.

Building Financial Literacy: Tailored workshops and educational resources to enhance confidence.

Promoting Generational Stewardship: Legacy planning and values-based strategies to foster continuity.

This ensures your family’s wealth is preserved and passed on with purpose and clarity.